Life Insurance

Brokerage

Markets We Serve

01.

Independent Life Insurance Agents

CPI was built from the ground up to support the needs of independent agents, and we continue to break ground and innovate in the life, annuity, disability, long-term care, and life settlement markets. We provide the most comprehensive suite of services in the industry, designed to free up your time and deliver the most suitable solutions for your clients.

02.

REGISTERED INVESTMENT ADVISORS (RIAs)

CPI’s partners are registered representatives with decades of experience in the securities business. We are licensed to sell every type of life insurance and are an especially good fit with IAR’s who need specialized support recommending our product offerings. CPI offers a solution for all RIA’s, whether your firm receives commissions or not, or wants asset-based compensation products.

03.

Broker Dealers

Having been a broker dealer ourselves, we are well versed in the distribution of life insurance and our other products through this channel. In particular, we serve as the front-end sales support and back-office processing unit for variable life policies, where your firm’s compensation is unaffected by our participation. For variable life, we are the no-cost back office of choice.

04.

Professional Advisors

We are an invaluable resource for accountants and attorneys. We provide professional advice regarding clients’ in-force life insurance policies, new product suitability, and direct-to-client sales and services.

Life Insurance &

Estate Planning

Annuities &

Income Planning

Underwriting & Case Design Skills

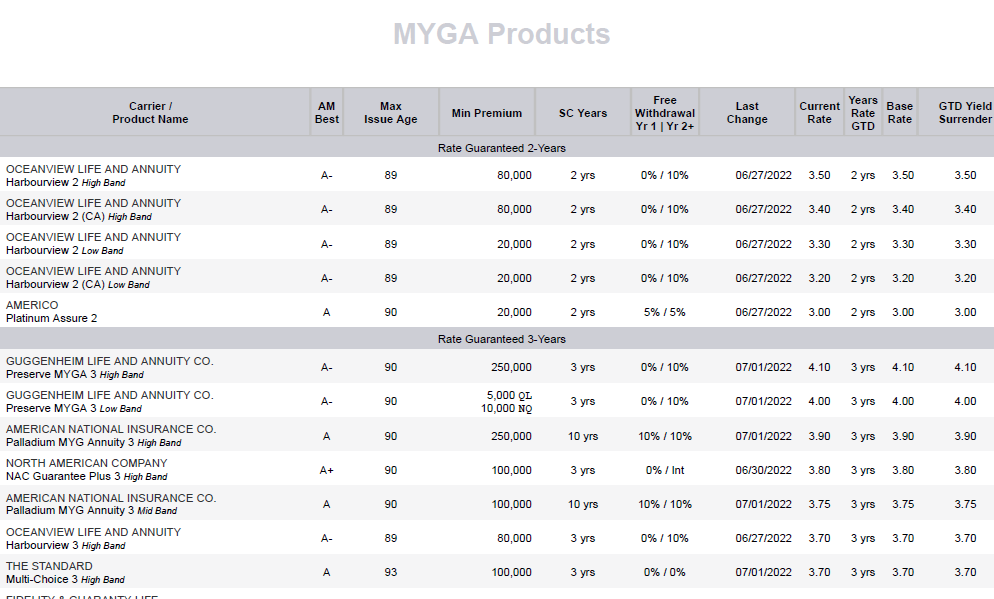

Access Annuity Rates

Discover trending and informative industry articles and posts.